The Global Tech Hub Report is a compilation of the development and progression of tech companies in metro areas across the world. Tech companies are on a steady incline; the growth, success and versatility of this industry and its contributions to the global economy and society are unparalleled. This report analyzes the quantitative data reflecting the tech hub industry, and compares how many deals are brought in, the value and amount of annual exits, the funding, unicorn creation, investments and more. All in all, while Silicon Valley is still the pioneer in everything tech hub, Asia’s technological advancements are rapidly coming for the top spot, particularly in Beijing and Shanghai. Overall, across the globe tech companies are a very promising industry. With successes such as Uber, Spotify, and DiDi, there is so much left in store in an industry that promotes economic growth, creativity, technology, and social impact. The information provided below is derived from CB Insight’s Global Tech Hub Report, which can be found at https://goo.gl/smfp73.

Comparing Tech Hubs and their Growth

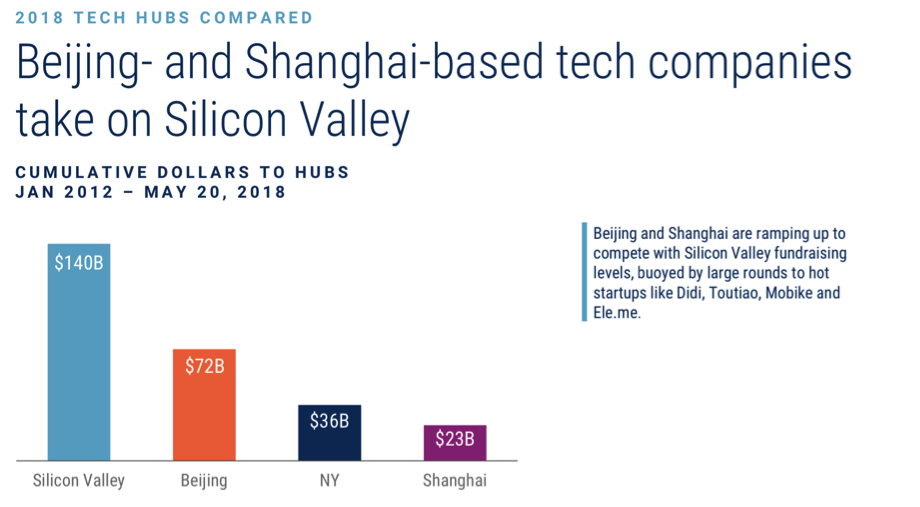

There are 25 metro areas where the tech hubs are located, ranging from the United States to Asia to South America. Since 2012, tech companies based in Silicon Valley has become the pioneer in drawing in deals, valued at around 140 billion dollars. Currently, Beijing and Shanghai are coming for the top spot, as their high growth and continuous company creation has made them the most promising hubs for the future. Yet, Silicon Valley possesses the leading amount of $100 million exits, followed by New York.

Asia’s rise in tech hubs have become a turning point for the industry itself, as a tech holding company in Japan includes a whopping 65 companies, which has catalyzed the development of tech. Moreover, Tel Aviv relies heavily on foreign funding for over ⅔ of their startups. Essentially, about 71% of their rounds are backed by foreign investors, followed by London at 44%. Investors are anticipating the next big exit, some previously including JD.come and Alibaba as some of the largest in history. From January 2012 until today, the cumulative capital of Beijing-based hubs is $72 billion, yet they are focused on replacing Silicon Valley as first place through the implementation of popular startups such as Mobike and Didi.

Yet, as much as Asia is attempting to surpass Silicon Valley, Silicon Valley is still undoubtedly at the forefront of tech hubs, as they have closed over 12,337 deals since 2012, which is more than any international hubs combined. As of May 2018, China is gaining traction as a tech unicorn, with a total of 40 unicorns in Shanghai and Beijing, compared to Silicon Valley’s 57.

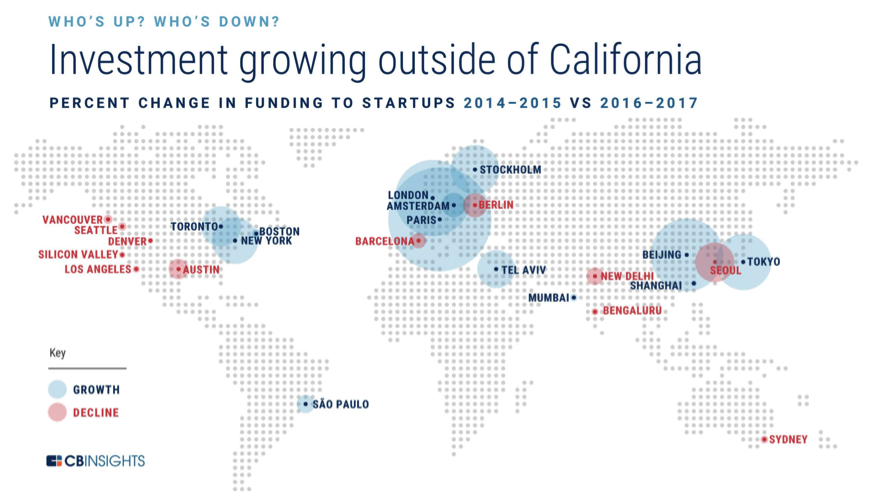

As of 2017, there is significant growth in tech hub investment outside of California, particularly in Toronto, New York, Paris, London, Sao Paulo, Amsterdam, Tel Aviv, Beijing and Tokyo. In particular, Stockholm’s growth is the most apparent.

Defining the Tech Hubs

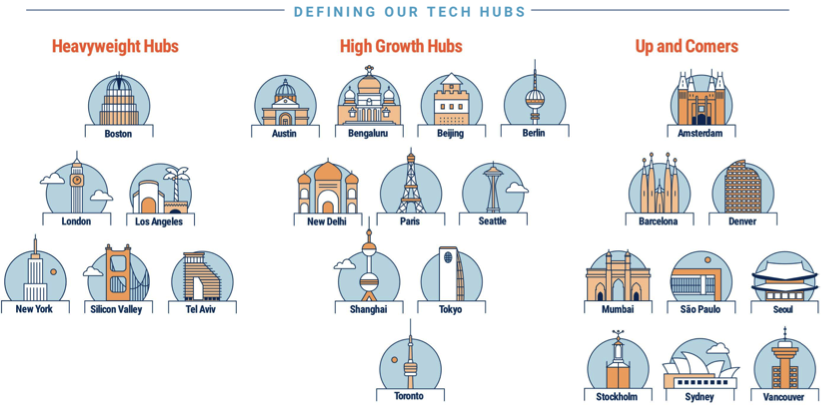

The three categories of tech hubs are Heavyweight, High Growth, and Up and Comers. Heavyweights include Boston, Tel Aviv, and Silicon Valley. High Growth include New Delhi, Paris, Shanghai and Beijing. Up and Comers include Amsterdam, Sydney, and Stockholm.

Heavyweight hubs are characterized by lower/stable growth rates, less new companies entering the market, high concentration of later rounds, and high density of engineering hiring. As of 2012, heavyweight hubs have made about 670 deals on average, and made about $38 billion. Heavyweight hubs are have also fallen flat in terms of equity deal progression. Furthermore, Tel Aviv has very few exits of hubs, but the small percentage of them are all high valued, well above $100 million each. Large exit values measure a successful state of a tech ecosystem. Silicon Valley has well over 200 exits, followed by New York, Boston, London and Los Angeles. Although, due to Tel Aviv’s breakthroughs in cybersecurity and software, corporate investors seek to put their money in Israeli rounds, exceeding corporate investment in Silicon at 25%.

Some of the most well-known heavyweight hubs are Uber, Infor, SpaceX and Deliveroo. For example, Uber, based in San Francisco, has acquired $15 billion in equity, and is valued at $68 billion. Some of their most recent investors include SoftBank Group and Sequoia Capital. Yet, with respect to mega rounds, Silicon Valley has secured top spot, as they have acquired 158 rounds greater than $100 million dollars as of 2014. Followed by New York at 40, Los Angeles at 30, London at 19, Boston at 13, and Tel Aviv at 2.

High Growth Hubs

The amount of hubs continues to rise as there is a higher frequency of early startups entering the market, as well as higher investments. Between 2012 and 2017, 14 billion dollars was raised and 171 deals were accounted for. With the higher concentration of early-stage companies, more deals are occurring and affecting the amount of high growth hubs. Specifically, in Beijing and Shanghai, the high growth hubs are skyrocketing, which allows the tech companies to raise a lot of money and turn out highly valued at exit.

Since 2012, Beijing has seen over 30 large exits with known tech companies, such as JD.com. The initial public offering was valued at 26 billion dollars, while Shanghai’s initial public offering was over 100 million dollars with 20 exits. Beijing and Shanghai are the dominant cities with the highest amount of exits.

Beijing and Shanghai have less rounds with foreign investors and mainly associate with local investors. In Shanghai, only 26% of rounds were with foreign investors, while 25% of rounds were with foreign investors in Beijing. In addition, Beijing and Shanghai associate less with corporate investors, with 34% of rounds with corporate investors in Beijing and 29% of rounds with corporate investors in Shanghai.

IU.com is a notable company with its headquarters in Shanghai. DiDi is a notable company with its headquarters in Beijing. DiDi raised $15B and is valued higher than IU.com. SoftBank group invested in DiDi, which is a has many other investments throughout Asia.

Beijing and Shanghai have dominated in mega-rounds and are ranked the two highest with rounds greater than $100M since 2014.

Up and Comers

The amount of up and comers in tech hubs has increased with the average deal count at 75 and the average investment at $2.5B between 2012 and 2017. This is caused by the lower deal counts than other hubs, lower investment, higher foreign investment rates, and a higher percentage of first-time funding rounds.

Specifically, Seoul and Stockholm have emerged and become dominant in the amount of up and comers present. In addition, tech companies based in Sydney, Australia have seen a high percentage of valuable exits, but Stockholm areas have seen the most exits valued at $100M or more.

Stockholm is known for many up and comers, such as Spotify and iZettle, and is a high-ranking up and comer. They have many top investors, such as Propel capital, Creandum, Almi, Northzone, and Industrifonden. They have had 648 total deals since 2012 and have raised $4B.

The percent of rounds with foreign investors is the highest in Stockholm than any other city or country. Stockholm draws foreigners and there has been a significant increase in the amount of foreign investors over the past five years.

While Stockholm has more foreign investors, Asian hubs tend to have more corporate activity. For example, Seoul has the highest percentage of rounds with corporate investors. Specifically, game development companies in Seoul have seen a lot of interest from corporates, China-based Tencent and Line Corp.

Coupang, based in Seoul, is a notable company that has a high value and has raised almost $2B. In addition, Klarna is a company based in Stockholm and is valued at $2.5B. These companies are the most notable since they have the highest investments and have the highest value.

Amsterdam and Sao Paulo have dominated in the amount of mega-rounds valued at over $100M since 2014. They both have eight rounds greater than $100M and this will continue to increase.

The Rise of Asia

Asia continues to have a large growth in the technology sector, now not just in production but in influence over new tech and its development. This is expressed through the rise of tech hubs, not just in the traditional China or India, but now in smaller countries like Japan and South Korea.

First rounds are significantly up in the region and have been constantly climbing in the past 5 years. In 2012, there were less than 50 first-time funding rounds in Beijing, Shanghai, Tokyo and Seoul, but now by 2017, there had been more than 400 combined between Beijing and Shanghai, and more than 200 combined between Tokyo and Seoul.

Exits have also come to be very popular in the region, with the majority of the larger exits coming out of China. With most companies revolving around online transactions, whether this is lending or grocery shopping, companies based out of both Beijing and Shanghai have seen big exits of more than 3 Billion USD.

There also seems to be a large amount of tech unicorns throughout asia, with the most, 29, in Beijing. These unicorns span throughout the four countries but Beijing also carries the highest valued ones, all in the 10s of billions.

Softbank, a Japanese telecom giant and tech holding company, seems to have a lot of investment and holdings throughout asia. Though it is based in Japan, its major holdings and interest seem to be focused in China and South Korea. It backs more than 66 tech companies, spanning throughout Asia.

The Exit Strategy

When it comes to Exits, the major tech hubs still seem to be leading. When the number of exits valued over 100 million were tallied up, the usual Silicon Valley came in first with 252 exits since 2012. Also included in the top 10 list were New York with 62 exits, London with 49 exits, Los Angeles with 43 exits, Beijing with 34 exits, Boston with 23 exits, Tel Aviv and Shanghai both with 19 exits, Seattle with 17, and Austin with 14. Some of the biggest exits include Facebook out of Silicon Valley for 104B, Spotify out of Stockholm for 29B, JD.com out of Beijing for 26B, and SNAP (Snapchat) out of LA for 25B.

Looking Forward – Tech hubs that didn’t make it this year:

- Chicago – Total of 4 tech unicorns in the region with a 5th born in Q1’18 – Tempus Labs, a biotechnology company.

- Shenzhen – Total of 5 tech unicorns with 15 rounds at $100M+ between 2014 and 2017.

- Singapore – 23% deal growth and 178% funding growth between 2016 and 2017. Two billion-dollar exits in 2016 and 2017.

- Hangzhou – High number of new startups getting funding and home of Alibaba headquarters.

- Montreal – Little tech activity, but home to McGill University (a top tech school)

- DC – 168% increase in deal activity between 2016 and 2017. Home to the Carlyle Group.

Source: CB Insight’s Global Tech Hub Report, which can be found at https://goo.gl/smfp73.

Written by Ilana Wolf, Daniela Schmutter and Ari Holzhauer, interns at Robus Consulting & Legal Marketing.